Fund Acquisition

GRK Team

Raising capital to accelerate sustainable traction, growth, and innovation.

About the Service

Fund Acquisition at GRK Foundation is a structured capital-raising service designed to support early-stage, growth-stage, and innovation-driven initiatives across technology, digital assets, and emerging ecosystems. We focus on enabling sustainable capital inflows that align with long-term value creation rather than short-term financial extraction.

Our approach combines strategic positioning, investor alignment, and disciplined capital planning to help projects and initiatives secure funding that supports scalability, operational stability, and innovation.

Introduction

Access to the right capital at the right time is one of the most critical factors determining long-term success. While capital is widely available across markets, misaligned funding structures, unrealistic expectations, or short-term pressure often undermine sustainable growth.

GRK Foundation’s Fund Acquisition service is built to bridge this gap. We help founders, initiatives, and investment vehicles raise capital responsibly—ensuring that funding structures support traction, innovation, and resilience while maintaining transparency and long-term focus for all stakeholders.

Service Brief

Our Fund Acquisition services cover the full capital-raising lifecycle:

Capital Strategy & Readiness Assessment

Evaluating funding requirements, growth stage, and capital efficiency to determine the most suitable fundraising approach.Investor & Funding Model Alignment

Supporting engagement across multiple funding models, including private capital, strategic partners, institutional investors, hybrid structures, and impact-driven funding.Pitch Structuring & Positioning Support

Helping present initiatives with clarity, credibility, and realistic growth narratives aligned with investor expectations.Capital Deployment Planning

Supporting disciplined capital utilization strategies to ensure funds are allocated toward traction, innovation, and operational sustainability.Governance & Transparency Orientation

Encouraging responsible reporting, accountability, and long-term stakeholder trust.

GRK Foundation does guarantee fundraising outcomes. Services focus on strategic enablement and capital alignment.

Earning Probability & Return Dynamics (Scenario-Based)

Earning potential from fund-acquired capital depends heavily on multiple variables, including market conditions, execution capability, sector maturity, and risk exposure. Rather than offering fixed or guaranteed returns, GRK Foundation emphasizes probability-based outcome ranges grounded in responsible investment logic.

Below is a generalized scenario framework commonly observed across technology, digital asset, and innovation-focused initiatives:

1. Conservative Growth Scenario

Capital Deployment Focus: Infrastructure, product stability, ecosystem development

Time Horizon: 3–5 years

Potential Annualized Outcome: ~6%–10%

Probability Profile: Higher likelihood, lower volatility

This scenario prioritizes capital preservation and steady traction, often suitable for risk-averse investors or long-term institutional alignment.

2. Balanced Growth Scenario

Capital Deployment Focus: Market expansion, partnerships, platform growth

Time Horizon: 2–4 years

Potential Annualized Outcome: ~12%–20%

Probability Profile: Moderate risk, moderate volatility

This is the most common outcome range for well-executed growth-stage initiatives with disciplined capital use and market alignment.

3. High-Growth / Innovation Scenario

Capital Deployment Focus: Rapid scaling, innovation, ecosystem acceleration

Time Horizon: 1–3 years

Potential Annualized Outcome: ~25%+ (with higher variance)

Probability Profile: Lower predictability, higher upside, higher downside risk

This scenario applies to breakthrough innovations and emerging markets, where outcomes are highly sensitive to execution and external conditions.

Important Note:

These ranges are illustrative, not promises

Returns may be lower, delayed, or negative

Capital is always subject to market, operational, and regulatory risks

GRK Foundation’s role is to improve probability alignment, not eliminate risk.

Conclusion

Sustainable growth requires more than capital—it requires the right capital, structured responsibly and deployed with discipline. Through its Fund Acquisition service, GRK Foundation helps initiatives raise capital that supports traction, innovation, and long-term value creation.

By focusing on strategic alignment, transparency, and probability-based outcomes, we aim to create funding pathways that benefit founders, investors, and ecosystems alike—without sacrificing responsibility for short-term gains.

Fund acquisition is not just about raising money; it is about building the foundation for enduring progress.

Fund Acquisition

Invest with USWe Take Funding from $500K to $100 Million in Investments. Giving 2x Returns for Holding Long term.

Crypto Mining

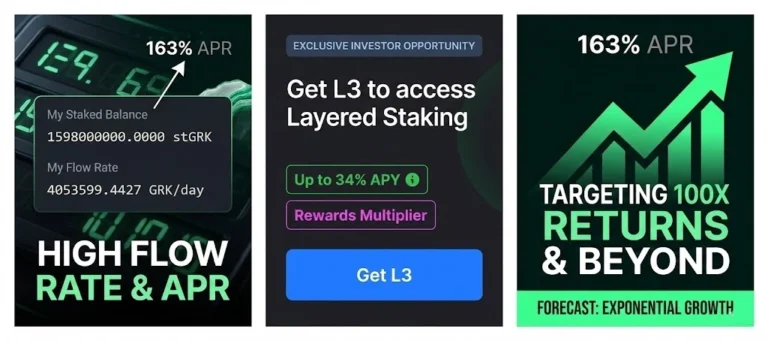

Crypto Staking

Token Investment

Higher Returns

Double Growth

Long Term Growth

Our Current Growth & Returns

Fund Acquisition

Invest with USWe Take Funding from $500K to $100 Million in Investments. Giving 2x Returns for Holding Long term.

Crypto Mining

Crypto Staking

Token Investment

Higher Returns

Double Growth

Long Term Growth